Some Ideas on Esg Investing You Need To Know

Table of ContentsSome Known Questions About Esg.10 Easy Facts About Esg ShownThe 6-Minute Rule for Esg StrategySome Known Details About Esg Investing

If you are a lot more resource-efficient, extra water-efficient, have less packaging, you will usually have a lower unit-cost structure. The 3rd location are your regulatory connections. If you are more responsible regarding your properties' environmental impact, after that the chances of a negative, revengeful governing end result are reduced, so there is potentially regulatory value here.In other words, is it that even more useful firms have the flexibility to focus on ESG topics, or is the concentrate on ESG enhancing their worth? Can you discuss that, Sara? Sign up for the Within the Approach Area podcast I assume that's one of the flaws of the research today.

That stated, I serve a whole lot of the capitalist customers and also they state that indeed, we might spend a great deal of extra time exploring whether there is a connection or actual causality, but in practice, offered they do not yet have that information, they wrap up that there is a link and attach that in mind.

What is your experience of how ESG is gauged and also what do you see as challenges? We recently researched to understand the landscape of sustainability coverage and also plenty of interesting conclusions appeared of that. Of all, it is indeed a location with a whole lot of info.

Everything about Esg Investing

The stakeholders have a difficult time making sense of all that reported information. A current study highlighted that while 90 percent of business report on sustainability, only 15 percent of investors can effectively incorporate this info right into their financial investment choices.

Several pick a number of, so you wind up with a great deal of data and, most of the times, minimal openness regarding exactly how that data associates with the firm's economic efficiency. We aim to give people with specials needs equal access to our website. If you would certainly such as info about this web content we will certainly be delighted to collaborate with you.

A metric like office diversity or water intake can be defined differently depending upon the standard you select to take on. There is no validation or auditing of this information, so as a stakeholder you can't be completely comfortable with its high quality. If we contrast this to monetary reporting, for example, we require to go back around 100 years to discover the very same degree of maturity.

There are additionally several initiatives to combine coverage as well as data. Should executives be thinking about ESG aspects throughout persistance, postdiligence, assimilation? As an acquirer you require to analyze the top quality of a property and ESG is basic to that.

All about Esg Sustainability

Are you acquiring into a possession that may be encountering into a regulatory headwind since it's not handling its carbon impact responsibly? Alternatively, are you buying into a possession that is well-positioned to expand given the consumer patterns and also can expect excellent growths in regards to talent and expenses? These components are very important to examine as component of the persistance similarly you assess the target's market position and client base.

You can then develop that right into your combination preparation in deciding which initiatives to accelerate in the acquired company or where to enhance ESG attention and minimize the threats. There is no bookkeeping of ESG information, so as a stakeholder you can not be completely comfy with its high quality. If we compare this to monetary reporting, we need to go back 100 years to discover the same level of maturation (ESG Strategy).

The initial one is to discover out the factors that are truly material in the property or sector you are checking out. Our research found that if you put all these standards and also structures together, there are around 40 different ESG locations. When you after that check out those with the lens of what is normally worldly, indicating what's in the public eye, we can narrow them down to around nine various ESG variables.

Getting My Esg Technology To Work

It might alter namesit was called corporate social responsibility prior to, and it's connected with the increase of focus on corporate purpose. The fundamental topic of the business's certificate to operate is here to stay.

Well now, that is the concern of the millenia. You can claim it is because it helps companies be a lot more lasting as well as much less likely to stop working. You might state it is since it aids to ensure that companies are putting their money right into the right things. You can state it is due to the fact that investing just in what you intend to see even more of on the planet benefits everybody.

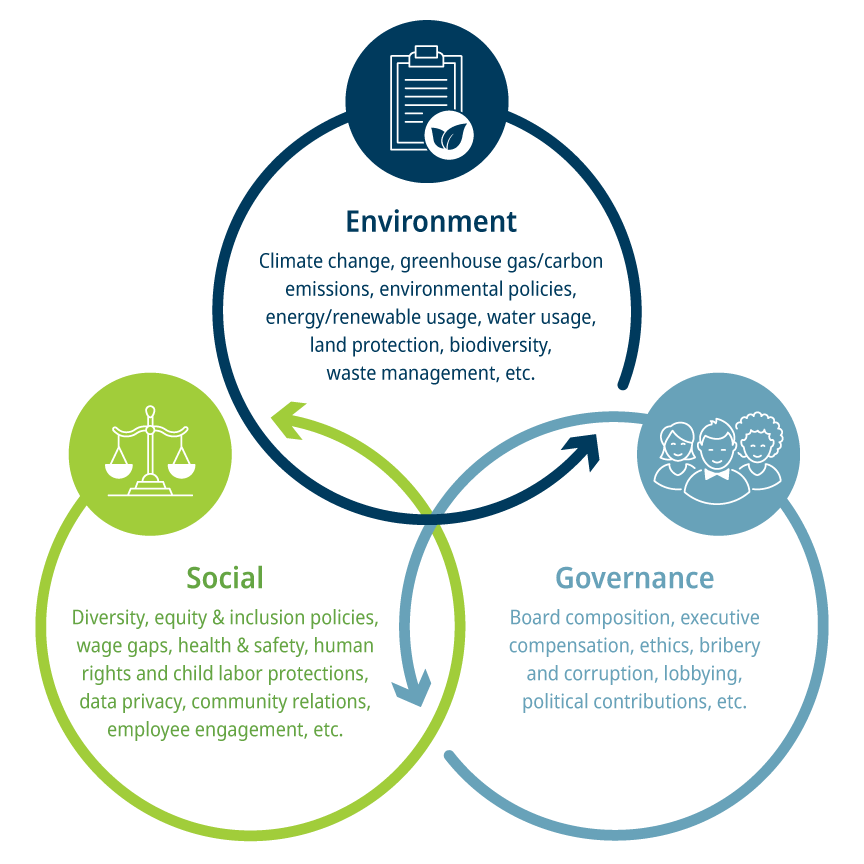

I am going to break ESG down for you in straightforward terms, so you can genuinely see what it's about. To address this concern I think it's vital to look at what ESG stands for.